Balenciaga Headlines a Buzzy Couture Week | The Week Ahead, BoF Professional

[ad_1]

A LONG-DELAYED DEBUT

-

Haute Couture Week runs July 5-8 in Paris with a mix of in-person and digital shows

-

Highlights include the couture debut for Demna Gvasalia’s Balenciaga and Pieter Mulier’s first collection for Alaïa

-

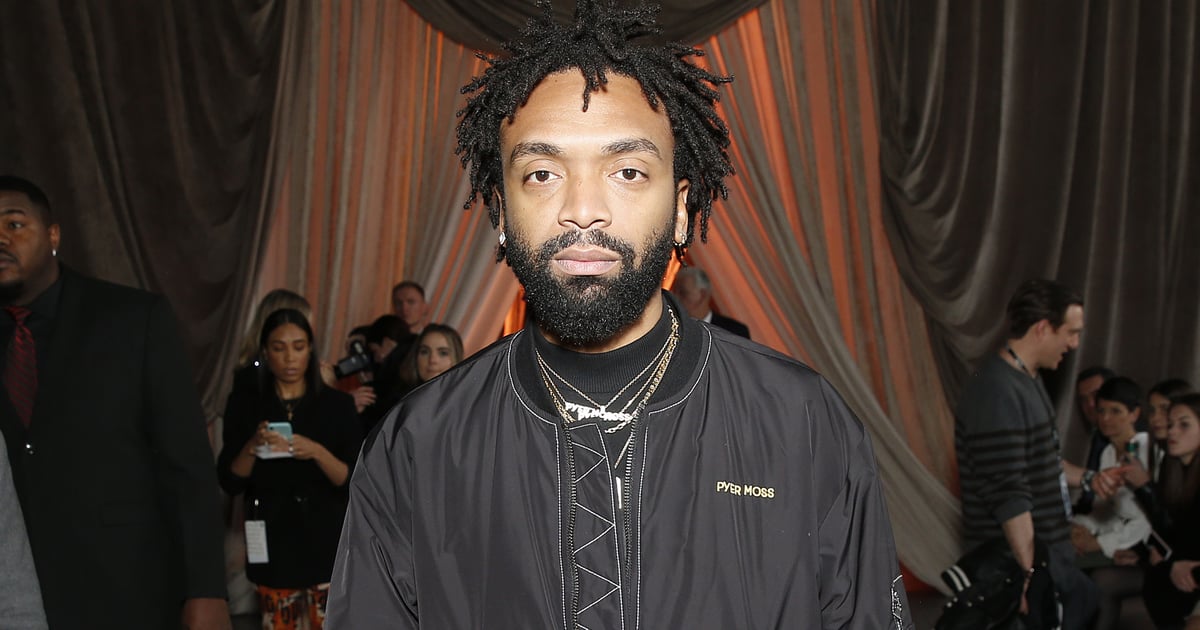

Kerby Jean-Raymond, the first Black American designer to show at couture week, will stream his show from the Madam C.J. Walker estate in Irvington, NY

If Marc Jacobs’ triumphant return to the runway last week marked the re-emergence of New York fashion from quarantine, couture week — and Demna Gvasalia’s Balenciaga show in particular — is likely to do the same for Paris. True, only eight of the 30-plus designers showing will do so before a live audience. But the week will be the luxury fashion industry’s first real reunion since the onset of the pandemic and has some notable highlights, including Pieter Mulier’s intimate debut show for Alaïa (the label’s first since the death of founder Azzedine Alaïa in 2017), Sacai’s Chitose Abe’s long-postponed guest collection for Gaultier. Pyer Moss’ Kerby Jean-Raymond will also become the first Black American designer to show on the official couture schedule.

The biggest event, however, will be Demna Gvasalia’s couture debut for Balenciaga, which also marks the brand’s first high fashion collection in over 50 years. Little is known about the clothes themselves — Balenciaga even wiped its Instagram ahead of the show — but Gvasalia has dropped a few hints, including that he plans to show designs for both men and women. And it’s likely that his approach will bring a modern, street-savvy edge to the traditional couture salon. It will be interesting to consider how the designer’s conception for his collection might have evolved in the 18 months since it was first announced. Over that period, Balenciaga has left the seasonal fashion calendar, released a collection via a video game, teamed up with Gucci and gone fur-free, among other endeavours. Stay tuned for Tim Blanks’ in-depth interview with Demna Gvasalia and Balenciaga CEO Cédric Charbit on the thinking behind their couture strategy.

The Bottom Line: While couture won’t be a major revenue driver for Balenciaga, the company aims to break even with the line and a strong collection could help it with its ambitions to become a megabrand.

STUCK IN TRAFFIC

-

Supply chain snarls have continued to worsen, with shortages, delays and rising costs common for both finished apparel and key materials

-

Shipping costs are at record highs as brands prepare to import clothes for the holiday season

-

Intermittent lockdowns in port and manufacturing hubs across Asia have added to the uncertainty

Take a moment to pity fashion’s logistics specialists. The operators responsible for getting clothes to stores, runways and e-commerce warehouses on time and in the right quantities are grappling with a global distribution system that is strained to the breaking point, if not beyond. The cause of the escalating waves of shipping surcharges, missed deadlines and unexpected shortages is no mystery: supplies of just about everything were artificially constricted by lockdown measures and canceled orders early in the pandemic, and could take years to fully recover. Meanwhile, consumer demand for fashion is surging as shoppers exit quarantine.

It’s no surprise then that the cost of transporting goods by container across the Pacific has risen 400 percent since the start of 2020, or that Fedex and UPS are raising package handling fees months ahead of the holiday rush. Fashion brands’ options to cope with their shipping woes aren’t pleasant; they can try to order merchandise earlier and in greater quantities, though that risks adding to the capacity crunch (and brands may be stuck with excess inventory if transportation bottlenecks open up sooner than expected). Brands can also try to manage customers’ expectations for what they’ll find in stores, and be transparent about any price increases that result from rising transport costs.

The Bottom Line: For now, companies are avoiding making radical changes to their supply chains, betting that the current snarls will resolve themselves soon. There’s reason to be optimistic: many economists continue to predict the recent shortages are a short-term phenomenon, and prices for some goods that spiked earlier this year, such as lumber, have already begun to recede.

The Week Ahead wants to hear from you! Send tips, suggestions, complaints and compliments to brian.baskin@businessoffashion.com.

[ad_2]

Source link

We use cookies to optimize our website and our service.

We use cookies to optimize our website and our service.

Responses